White Paper 1.2

1. Abstract

MetalSwap is a decentralized platform designed to facilitate hedging swaps within financial markets. The primary objective is to offer risk coverage to those involved in commodity trading while also presenting an investment opportunity to those contributing to increased liquidity within the project. This allows to provide protection to a growing number of market participants.

Currently, financial swaps serve as the most widely adopted risk management tool in large-scale raw material exchanges, particularly within the metals sector. However, these transactions primarily occur within centralized markets, necessitating financial hedging and access to credit lines from banks. Unfortunately, these resources are not always easily accessible, and bureaucratic procedures can be restrictive.

To face these challenges, we've introduced an economic incentive system driven by the distribution of the governance token ($XMT). This approach ensures publicly accessible pooled liquidity. Through a series of smart contracts, initially implemented on the Ethereum blockchain, it's possible the execution of swaps without the need for intermediaries, resulting in reduced costs and no time restrictions.

2. Background

Issues of the current commodities supply system

-

Erosion in profit margins: The persistent demand for efficiency improvements in purchasing exerts pressure on commodity consumers, pushing them to negotiate for increasingly competitive prices. This constant pressure, in turn, reduces the profits of producers.

-

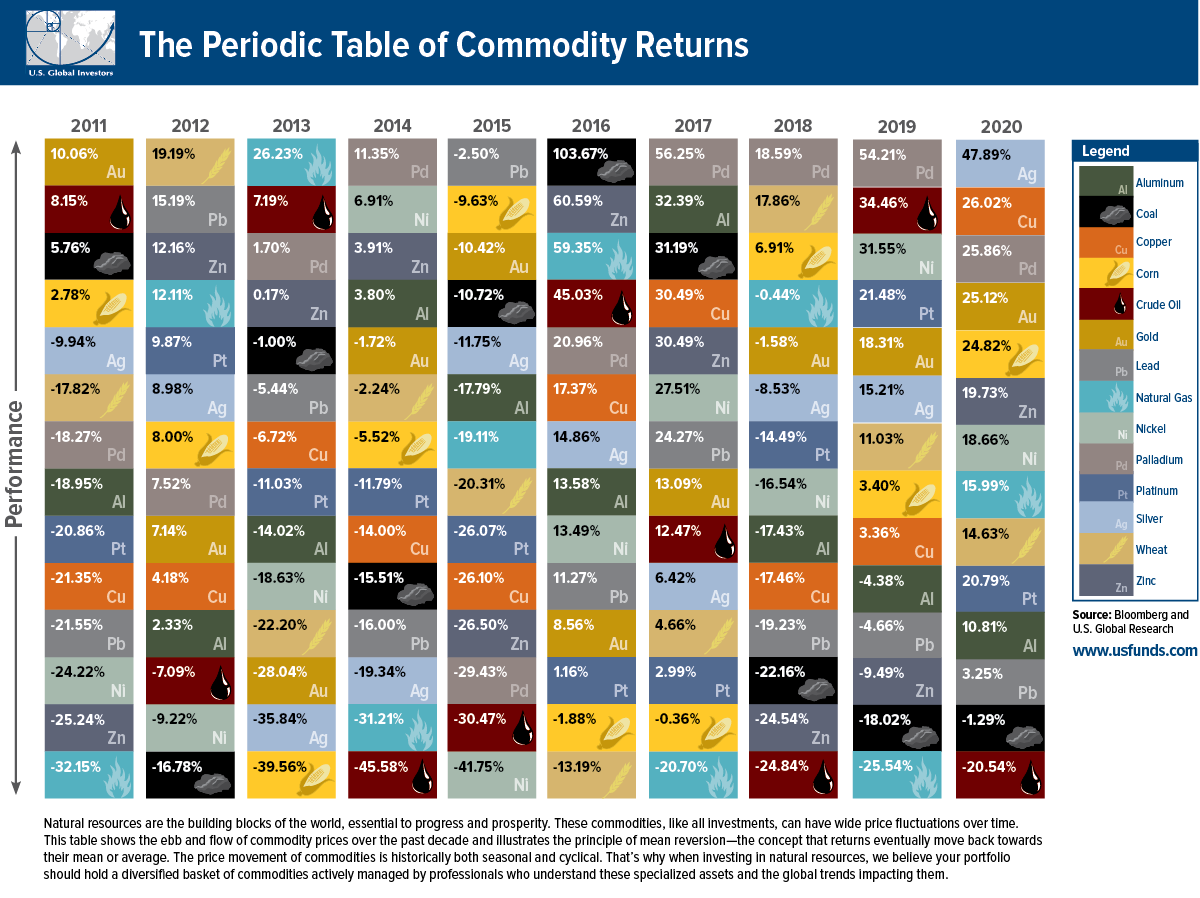

Excessive price volatility: Excessive price fluctuations obstruct effective planning and make it difficult to secure a consistent profit. To mitigate this challenge, financial hedging is necessary. However, the traditional hedging process can be time-consuming, taking hours, if not days. In a market where prices can change quickly, even a few hours of delay can result in significant profit losses. (Not to mention when the hedge is executed several days later, as is often the case in this industry.)

-

Commitment to purchase volumes “without security": Buyers of raw materials are compelled to place orders significantly in advance of scheduled supply, with no assurance that demand will remain constant.

For instance, consider a chair manufacturer who sold 2,000,000 chairs the previous year. To produce these chairs, they need to order metal for the chair legs in advance, assuming they will sell a similar quantity this year. However, there is no guarantee that this will be the case.

This commitment to buying materials in advance poses a dual risk:

- Reduced Profits: If demand falls short, the manufacturer earns less revenue.

- Customer Loss: In the event of insufficient supply, customers may turn to competing suppliers, resulting in lost business opportunities.

What happens if the manufacturer does not sell 2,000,000 chairs this year?

If the manufacturer sells less than 2,000,000 pieces this year, he would have excess metal in stock, which may have been purchased at a higher value than the current market price. This situation lead to financial losses. Conversely, if he were to sell 3,000,000 chairs, he would need to purchase additional metal, potentially at a significantly increased cost. This might result in selling the chairs at a loss or with minimal profit.

Request for price adjustment in case of fluctuations exceeding 10%

In the scenario described above, the chair manufacturer might find it necessary to charge his customers a much higher price than the initially agreed-upon rates. This adjustment may be required to accommodate the increased cost of procuring metal, which has experienced a significant price surge.

The traditional Centralized Finance solution

Traditional finance attempts to solve its problems through the tool known as "commodity swap".

A commodity swap is a contract between two parties designed to set the price of a certain commodity. The functioning of this tool is similar to that of a standard swap:

once a notional capital is defined, both buyer and seller agree to make periodic payments to each other. The first party's payment is based on a fixed parameter, while the second party's payment is based on a variable parameter reflecting the price trend of the underlying commodity.

Commodity swaps were introduced in the mid-1970s to allow producers and consumers to mitigate price risk in certain markets.

Indeed, the consumer typically pays the "fixed leg" of the swap to safeguard against a potential price increase, while the producer pays the "variable leg" to protect against any price decrease.

The components of a swap include:

- the notional capital of reference,

- the contract's stipulation date,

- the swap's duration.

In 2019, the volume of commissions generated by financial hedges inherent to commodities was more than a Billion dollars. This figure exclusively pertains of the LME (London Metal Exchange) volume, which is only one of three major players in this sector, alongside the CME and SHFE.

DeFi is constantly expanding and attracting a growing amount of capital allocated to the various protocols, which act as combinable LEGO® bricks.

(Technically this is referred to as TVL).

As a first step, even acquiring a very small share of this market would result in a huge decentralized volume highlighting the advantages of MetalSwap.

CeFi Issues - The centralization problems

Current centralized systems suffer from significant drawbacks:

- Costs: The intermediation system has structural costs (such as office space and employees expenses), which are reflected in the commissions traders pay to open financial hedge positions.

- Trust: Funds are entrusted to centralized services that allow position openings. This requires trust and guarantee in the service provider and in its offer

- Monopoly: Market analysis reports the centralization of operational volumes among a small group of brokers, which is configured as a monopoly. This results in the imposition of costs dictated by a few players who set prices at their convenience.

- Need for bank coverage: The current system relies on bank coverage, necessitating additional level of trust. It should also be considered that in some areas, like Africa, the lack of access to banking network creates a significant barrier to traditional financial instruments.Additionally, segment of the global population PHYSICALLY lack access to financial systems due to political restrictions.

- Limited Access to hedges in specific times: While the market operates continuously, offices do not. An operator in Asia might be required to follow office working hours in time zones as distant as London or Chicago, where the main markets are headquartered.

The benefits of MetalSwap, DeFi's solutions

The issues highlighted above, related to the CeFi (Centralized Finance) context, find their natural solutions with MetalSwap, developed on a DeFi (Decentralized Finance) system.

- Costs minimized: Commission costs on hedging swaps in MetalSwap are significantly lower as there is no need of intermediaries. The platform is entirely based on blockchain technology through the use of smart contracts.

- Trustless: Since there are no intermediaries, there is no need to trust third parties. Funds remain in your wallet and you have full control over their management.

- Decentralization of the system: MetalSwap overcome monopoly issue through intrinsic automatism and decentralized finance.

- No need for bank coverage: Bank coverage is no longer necessary: MetalSwap implemented a shared liquidity pool system, where each participant (Liquidity Provider - LP) is rewarded for their contribution with governance tokens (XMT). Through XMT, it is possible to propose and/or vote on initiatives to expand the project. MetalSwap allows you to open hedge positions only if they can be counter-guaranteed by liquidity pools. In MetalSwap trust is unnecessary, as the system is entirely trustless and mathematically secure.

- Market open 24/7: Unlike traditional offices with their limited hours, MetalSwap operates 24 hours a day, 7 days a week.

3. Decentralised swaps

How traditional commodity swaps work

- You need to find a bank that deals with this specific financial instrument.

- You need to reach out that bank and ask if they would be willing to extend trust to cover your financial needs.

- Assuming the bank agrees (without talking about timing complications), you have to request coverage for the specific contract you are struggling to close.

- You have to patiently wait for the bank's response.

- You are required to sign the conditions that are IMPOSED on you in paper form.

- The day you want to close the transaction, after fulfilling the supply contract, you must return to the bank.

- You initiate the request to close the file.

- You have to wait "confidently" for sustainable closing conditions to be established.

- When you accept the IMPOSED conditions despite yourself, you are subject to the bank's "technical" time.

- Finally, you can do the necessary calculations and find out the economic result of the operation (which could also be NEGATIVE).

How traditional commodity swaps work

- User-Friendly WebApp: Open the WebApp.

- Define Your Financial Goals: Choose the economic result you want to achieve.

- Self-Serve Autonomy: Do everything in complete autonomy.

Technological goals

The MetalSwap project aims to implement the financial operation of swaps between two assets through a decentralized IT structure on Blockchain technology.

Specifically, use is made of the ability to execute distributed code, offered by certain Blockchains, to facilitate programs (Smart Contracts) that implement swaps between crypto assets.

The assets being swapped change

While the basic operation of the swap remains the same as in financial markets outside the Blockchain ecosystem, efficiency is significantly increased.

MetalSwap plans to create synthetic tokens that accurately reproduce the performance of real commodities in the metals and commodities market. These created swaps can be accordingly traded. The software development timeline initially envisages the implementation of smart contracts on the Ethereum blockchain, with potential expansion to other blockchains like Binance Smart Chain, Solana, Polygon and more.

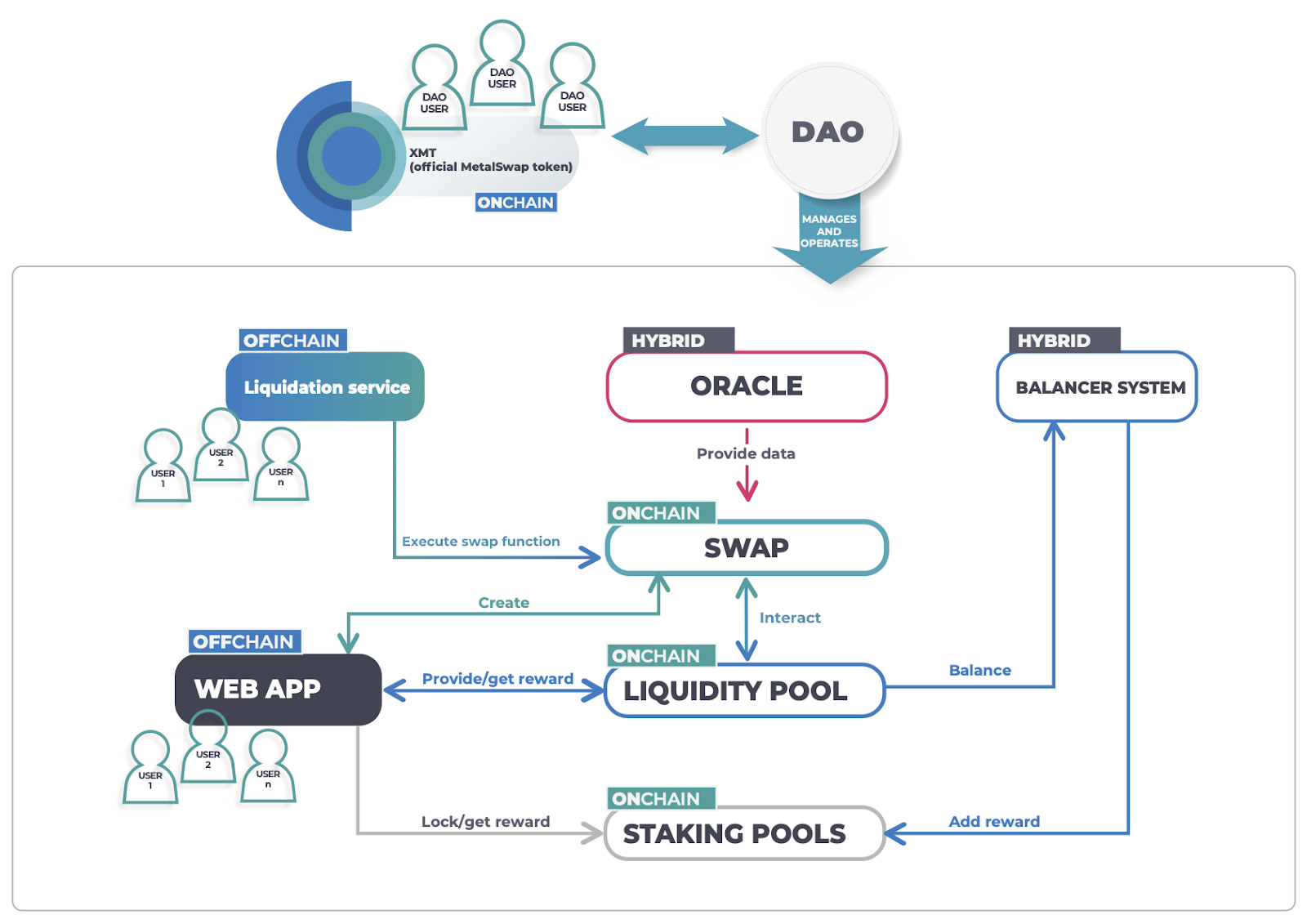

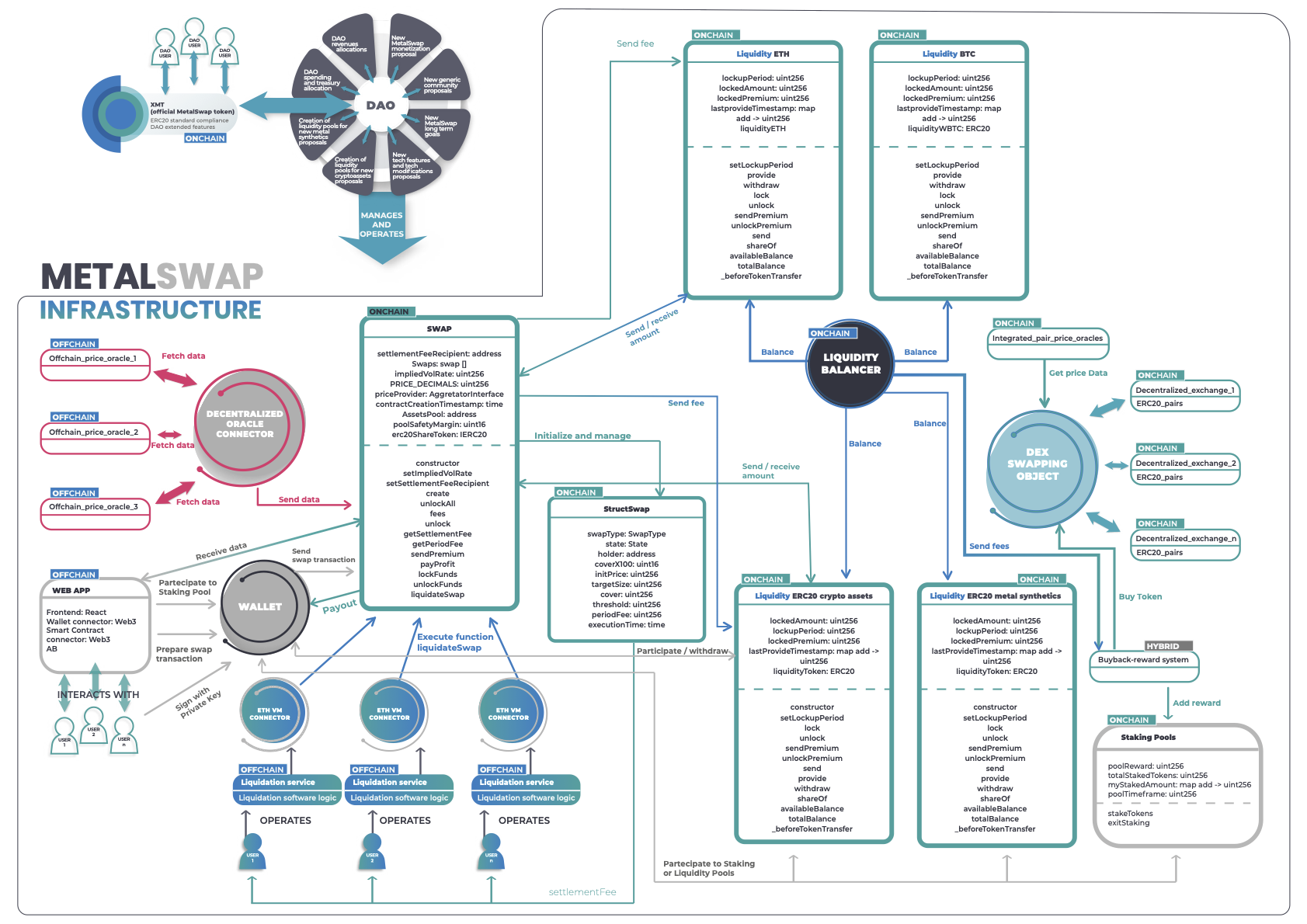

Technological architecture overview

The technological architecture of MetalSwap (as illustrated in the figure below) is the result of several incremental iterations involving requirements gathering, technical analysis and formalization according to current industry best practices.

The proposed features will be incrementally added based on the modular technological blocks created previously.This approach gives rise to a dynamic ecosystem, capable of responding quickly to evolving industry conditions and user needs. In addition, it ensure compatibility with various frontend that connect to the Blockchain and therefore easily modular or integrable into other projects or graphical interfaces.

A number of different technologies are used for:

- Blockchain components (smart contracts, data feed oracles, decentralised exchanges, etc.),

- Backend (servers for web app instance context maintenance, server databases, etc.).

- Frontend (graphical interfaces of the reference sites and web apps)

However, this document will mainly focus on the Blockchain elements that constitute the core functionalities of MetalSwap. The decision-making body of MetalSwap's technological infrastructure is a "DAO" (Decentralized Autonomous Organization) control structure consisting of all users holding the project token.

Owing this token gives users the right to vote in proposal made by other members, where each individual vote's weight is directly proportional to the number of tokens held.

MetalSwap's DAO has complete control:

- protocol development decisions,

- proposals and implementation of new monetisation models,

- distribution of generated fees,

- technological implemented features,

- creation of new pairs of crypto assets and their liquidity pools.

The MetalSwap project token operates on the Ethereum Blockchain and adheres to the ERC20 technical standard. It also implements the "burn" function to enable deflationary monetary mechanisms, along with additional features useful for managing interactions with the MetalSwap DAO.

This token will have a limited supply cap of two billions, and it is not possible to create more money after the initial creation (at TGE).

Swaps are implemented through a series of Smart Contracts running on the Ethereum Blockchain.

These, together with the code of the Smart Contracts of the Liquidity Pools, control the core application logic of the project.

The pools are fundamental to provide the required liquidity immediately as new swap positions are opened or closed, and they are secured with a certain percentage of collateral.

Users participating in liquidity pools, "liquidity providers", receive a substantial portion of the protocol's generated fees, incentivising to increase their contribution.

In order to keep track of their movements in the various liquidity pools, once the assets have been deposited on the smart contracts, users receive an ERC20 token, generically denoted as 'liquidity tokens', representing the liquidity provided for each pool, .

To maintain balanced liquidity pools, it is implemented a special on-chain module: the "liquidity balancer".

In order to obtain accurate and timely data for the assets involved in the swaps, blockchain technologies and Oracles-based infrastructures are involved. Those collect data from various sources, given the physical nature of the metallic assets listed on the exchanges.

For certain 'swappable' crypto assets, it is sufficient to estimate the price based on trading on decentralised exchanges.

For others, it is necessary to retrieve current prices from data aggregators (Oracles) that collect and analyse the market from NUMEROUS centralised exchanges in order to avoid errors or manipulation.

Technical features in detail

Swap

Ethereum smart contracts responsible for swaps are in charge of their creation, monitoring and closure by interacting with liquidity pools.

Each swap is defined by certain parameters:

- the "SwapType" indicating the crypto asset pair involved in the swap and the direction in which the swap is being made (e.g. ETH/USDT or USDT/ETH);

- the "state" indicating the execution state of the swap is (active, liquidated, executed, closed);

- the address of the swap's owner;

- the initial asset price from which the swap starts at its creation, passed by the priceFeed oracles;

- the "Target Size" which expresses the entire economic amount involved in the swap; generally only a not precise percentage is paid (see "cover");

- the "Cover" indicating the percentage of the target Size that the user wishes to pay on the smart contract, it is a true financial leverage: if a swap is opened without having the total amount required by the cover, it involves a lower allocation of resources, even if the risk of seeing the position liquidated should be carefully evaluated, which can be managed later;

- the "Threshold" is the price threshold for liquidating the volatile asset of the swap; it is calculated as a percentage (expressed by the "cover") multiplied by the "target Size" subtracted or added to the initial price according to the "swapType"; and is modifiable at a later date;

- the "executionTime" reporting the timestamp when the swap reaches its natural closure;

- the "fee" calculated based on the target Size, the duration of the swap and the Implied Volatility Rate of the volatile asset of the swap; a fixed fee is added to cover GAS costs of the swap liquidators.

As with all DeFi protocols, before completing the swap creation, it is necessary to grant permission to the smart contracts on the addresses used in the swaps.

This enables the movement of various crypto assets and the funding of new swap positions from user the addresses.

Once the allowance is granted (only needed once for each address) the swap is created and funds are allocated in the various liquidity pools.

The swap can have four possible states:

- Active: Once the swap is created, it is marked as active and can move to the other 3 states. It will remain active until the executionTime, or until all cover is used, or until the user closes it prematurely.

- Executed: The swap is completed when the specified period expires and payoffs are paid according to the price trend from the liquidity pools. At this point the cover is returned to the user. In case of a unfavorable market performance, the amount corresponding to the cover's difference is deducted and the swap is moved to the liquidity pools. The remainder of the cover, if any, is returned to the user and the swap is concluded, thus executed.

- Closed: The user decides to close the swap before the indicated period, payoffs are paid according to the price trend from the liquidity pools. Penalties for early closure of the swap vary depending on the time difference compared to the executionTime, deducting them from the cover the user paid at the opening. If insufficient cover exists to cover closing costs, the swap cannot be closed and the user must first refinance it in order to proceed.

- Liquidated: The swap is liquidated if the price of the volatile asset face a significant fluctuation, eroding the entire paid cover (i.e. exceeding the previously calculated threshold value). Liquidity pools retain the cover and the user receives nothing. Users can prevent liquidation by adding more cover as soon as they notice a decrease in it, without incurring additional fees; the threshold is adjusted accordingly.

Liquidity pools

Liquidity pools represent the store of value that funds MetalSwap's operations.

The liquidity injected into the Liquidity Pools consists of all crypto assets suitable as underlying assets for swap transactions. This liquidity is contributed by users who decide to allocate their assets by becoming liquidity providers (LPs).

As compensation for their service, LPs will receive a certain amount of official project tokens, which can be used for project governance purposes.

In order to guarantee stability of swap pairs , the liquidity balancer technology module is used, with the function of maintaining uniform levels of reserves of the various assets between pools.

Staking pools

Staking pools are used to incentivise the blocking of project governance tokens, offering rewards to users who choose to participate in these pools.

These rewards are managed using a system of weighted averages, that take into account the duration for which crypto assets have been allocated in the pool, as well as the amount of tokens paid in.

At the end of the staking period, fixed at the creation of each pool (e.g. 30 days, 90 days, etc.) the reward in tokens, previously blocked in the pool's smart contract, is distributed, according to the weighted average system.

Other systems in the architecture can be used to increase the various rewards (e.g. Dao voting or the Buyback reward system) of the pools. The accumulated reward can be requested through the smart contract function connected to the web app GUI.

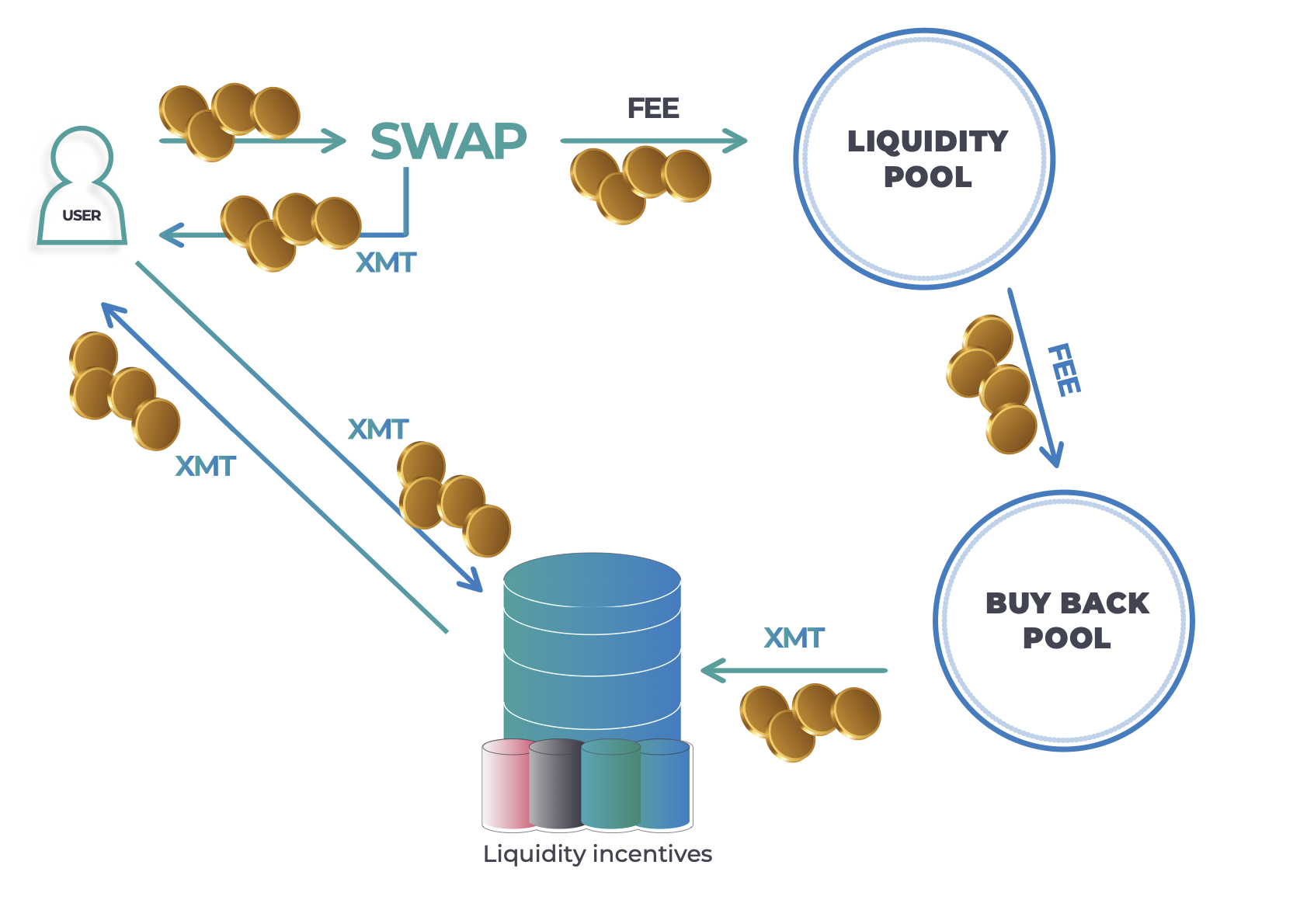

Buy-back system

A large proportion of the fees generated by the system will be used for a smart contract system responsible for the repurchasing XMT tokens from decentralised marketplaces (such as Uniswap).

The buy-back system will help contribute to the demand for XMT tokens and, at the same time, add tokens to the various incentive schemes, according to the logic pre-established and/or voted by the DAO.

WebApp

The webApp is the portal through which users interact with MetalSwap's services.

The webApp does not keep any user identification data and only requires the user to login with the web wallet.

All the information of user's operations, including the status thereof, are saved through the address of their wallet directly on the smart contract.

When the user is performing operations, for example creating a swap, the webApp sends the data entered in the frontend, directly to a node of the blockchain, thanks to the web3 connector and a series of ad-hoc libraries.

These libraries allow interaction with smart contract functions using JSON-RPC calls and prepare the transactions that afterwards are passed to the Web Wallet module.

The user only need to sign the transactions, confirming them through the Web Wallet GUI, and then he can comfortably follow the status until the execution is completed.

The webApp is implemented using an open-source and component-based Javascript library, React, with an asynchronous state management via redux paradigm.

Oracles

MetalSwap relies on a number of oracles, devices, or entities that can provide blockchain applications with reliable and timely data from contexts external to the blockchain, as well as from other blockchain services and markets.

In order to enhance system resilience, MetalSwap relies on both two types of decentralized oracles made available by decentralized exchanges (e.g. Uniswap) and those provided by the Chainlink decentralized oracle network.

This allows smart contracts to receive sufficient market data to operate properly and ensure protection from financial exploits.

Liquidation service

The liquidation service performs a fetch of all active swaps from the blockchain network and controls their parameters in order to manage the swap execution and liquidation system.

For example, if a swap runs out of time, the liquidation service will be able to "execute" it and also receive a reward to compensate for the gas spent to enter the transaction into the blockchain.

Anyone can try to close and liquidate the swaps, checks on the correctness of these executions are managed by the "requires" inserted directly into the smart contracts.

DAO

The DAO constitutes the decision-making body of the MetalSwap project.

It is composed of a series of smart contracts (acting as the main governance token) with which token holders can interface via webApp to vote on proposals and create new ones.

The DAO contract, through cross contract calls, may be able to directly execute the code of other smart contracts (after successful voting).

Proposals that can be created can cover a few predefined categories, with some of them implementable in an automated fashion by the DAO's smart contracts, such as transferring project tokens in order to fund worthy user initiatives in support of MetalSwap, or as funding to support projects and enrolled technology integrations of the MetalSwap ecosystem proposed by users.

Among the types of proposals, it is possible to find ideas about long term or short/medium term objectives, both about MetaSwap features as well as about its technological macro-developments, for example:

requests for new integrations of technological features to ensure compatibility with other ecosystems and/or blockchain markets, or requests regarding the creation of new synthetic crypto assets representing commodities, currently not yet included in MetalSwap.

Holders of governance tokens can express their opinion on the worthiness of the proposals.

The vote has a weight directly proportional to the number of governance tokens held in the owner's wallet.

A forum dedicated to the free exchange of opinions, ideas and suggestions is available to all the community interested in MetalSwap.

Proposals related to requests for the implementation of new technological features will be subject to a technical/legal feasibility study before their actual implementation by staff employed by the MetalSwap Foundation.

4. MetalSwap Tokenomics (XMT)

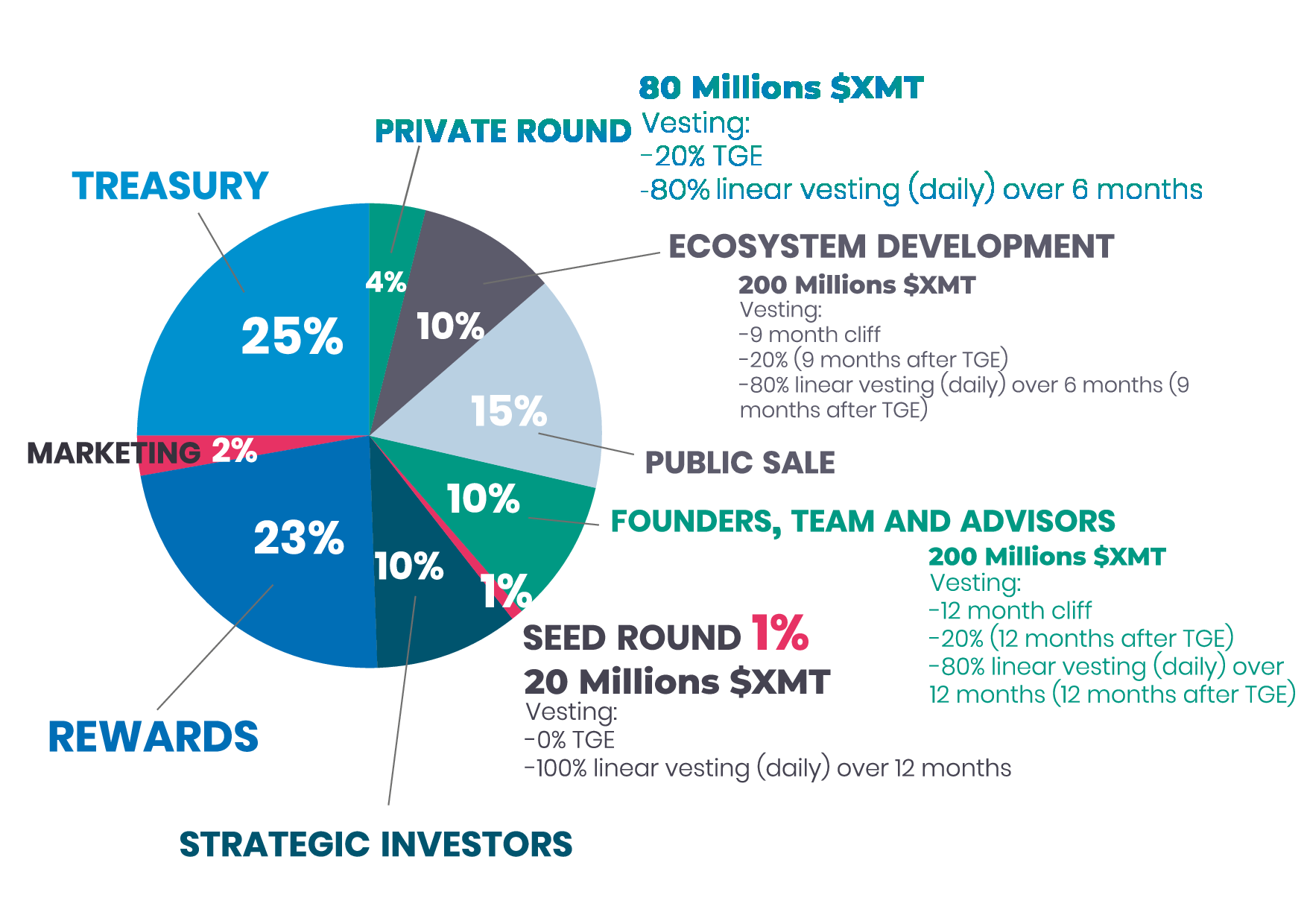

The purpose of XMT Tokens is to participate in DAO deliberations. They are allocated as shown in the chart below:

Token Info

Ticker: XMT

Name: MetalSwap

Maximum token supply: 2B

Decimals: 18\

Metrics

Founders, team and advisors: 10% of tokens with 2 years vesting

Ecosystem Development: 10% of tokens with 15 months vesting

Seed tokens: 1% of tokens with linear vesting over 1 year

Private tokens: 4% of tokens with 6 months vesting

Treasury: 25% of tokens

Public sale: 15% of tokens (1% IDO)

Rewards and Community: 23% of tokens

Marketing: 2% of tokens

Strategic investors: 10% of tokens

Distribution to early users

XMT Tokens will be initially distributed to protocol early users via swap incentives, liquidity incentives, AMM, test-related incentives, and Bug Hunting campaigns.

All incentives fall under the "Rewards and Community" heading, which will be fueled through the token buy-back system explained in this document.

Staking

People who believe in MetalSwap and want to increase the power of their vote can stack their tokens to receive an incentive and increase the number of tokens.

Incentives details

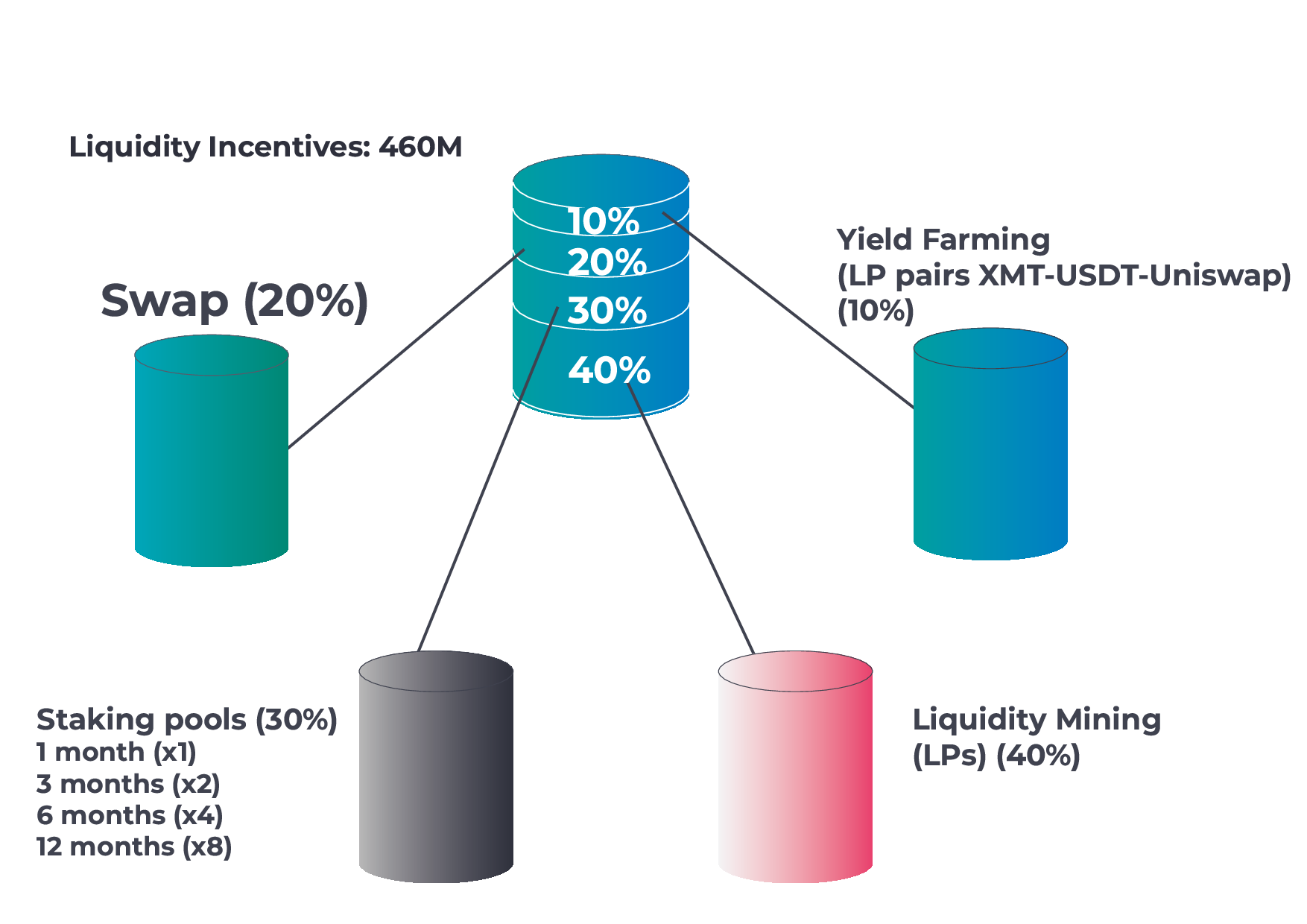

The following image is a proposed distribution of "Liquidity incentives" that will be subsequently confirmed or changed based on the DAO voting.

Governance

MetalSwap, through governance tokens, allows project participants to design the future of the project.

XMT Tokens are used to make new proposals and/or vote on proposals that have been made.

A minimum threshold of governance tokens will be required for a new proposal .

Voting power depends on the amount of tokens held, staked or delegated.

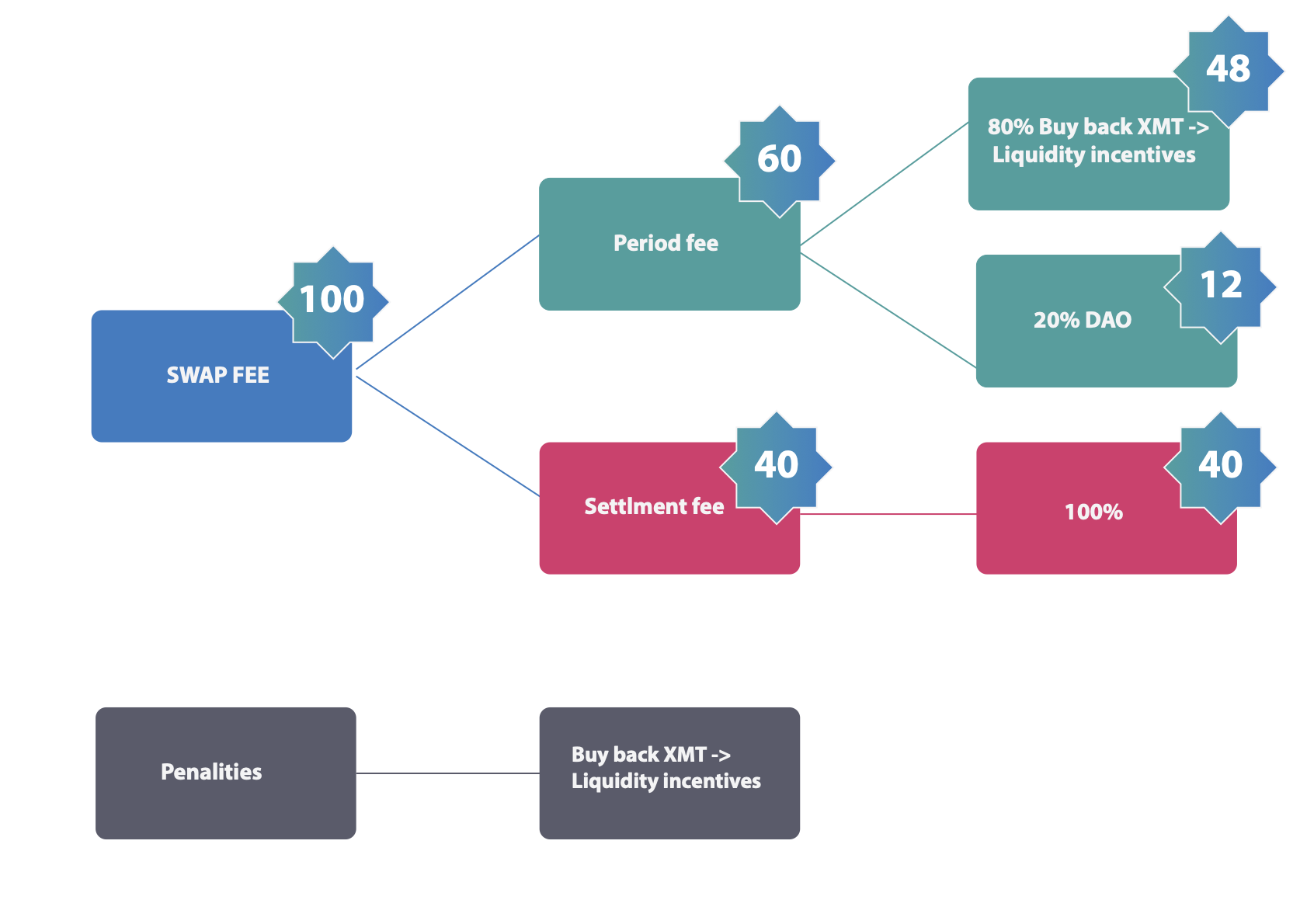

Fees distribution

The foreseen fees are classified into two different categories.

- Swap Fee, generated by the execution of a swap and composed of Period Fee and Settlement Fee.

- Penalties Fee,

- exit fee: generated when exiting the pool before maturity;

- swap fee: generated by early termination of a swap contract.

5. Token Flow (XMT)

6. Private Sale

In September 2021, the Seed Phase took place which raised 1.018.498 $ , distributing 20.369.960 $XMT namely the 1,02 % of tokens with linear vesting over 1 year

One month later, MetalSwap’s Private sale raised a total of 8.332.526 $ , distributing 83.325.260 $XMT namely the 4,17 % of tokens with 6 months vesting

7. MultiChain

In December 2021, the first DAO proposal was officially published ( https://app.metalswap.finance/#/governance ):

Should $XMT be bridged to BSC?

The proposal was voted on and subsequently approved on 31 December 2021.

Thus, in late January 2022, $XMT landed on BNBChain and in April, on **Polygon Network'**s Mainchain.

MetalSwap's main app has since then had a new Bridge section that allows users to take advantage of Multichain.org's routing mechanisms directly from the MetalSwap app.